PropNex Picks

|September 19,2025Buying a Foreclosed Home?

Share this article:

When it comes to property hunting, most people go for new launches or resale homes. But there's one corner in the market that isn't so common amongst Singaporeans, and that is foreclosed homes.

So, is there any value in these residential units? Or should you just look elsewhere? Here's everything you need to know.

Also known as distressed properties or mortgagee sales, foreclosed homes are properties repossessed by creditors (typically banks) when debtors (typically owners) default on their mortgage. Once that happens, the bank takes possession of the property and puts it up for sale, usually through an auction.

The main goal of the bank is simple: recover the outstanding loan amount. They aren't looking to hold or profit, which is why foreclosed homes sometimes get attention from bargain hunters, even though it's such a niche market in Singapore.

Foreclosed homes aren't common in Singapore since home loans are subject to strict measures like the Total Debt Servicing Ratio (TDSR), Mortgage Servicing Ratio (MSR), and Loan-to-Value (LTV) limits, which ensure borrowers don't overstretch themselves. On top of that, homeowners can use their Central Provident Fund (CPF) to pay their monthly mortgage repayments. That's why foreclosure is a very small and niche segment of the market.

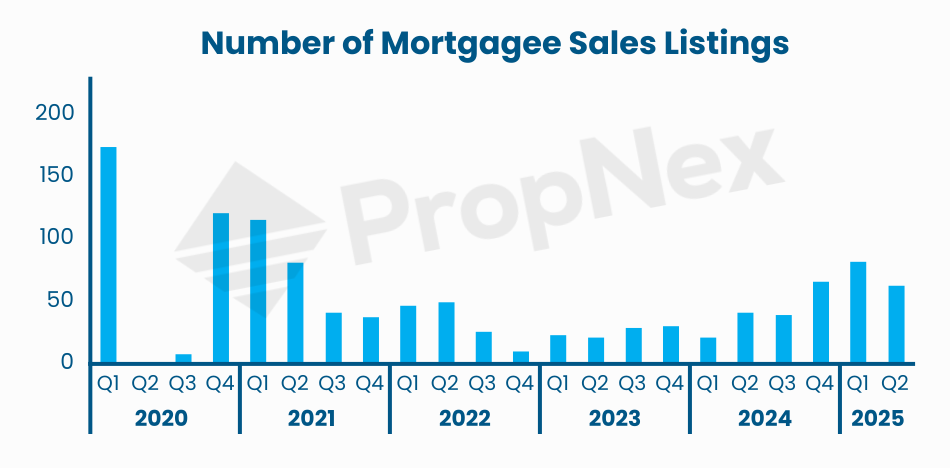

In fact, the number of mortgage sale listings has been under 200 over the past five years. It even went down from 83 in Q1 2025 to 64 in Q2 2025. For context, resale transactions for HDB and private residential units (excluding ECs) in Q2 2025 were 7,102 and 3,647 respectively.

The recent decrease in mortgagee sale listings could be due to easing interest rates, which have helped more homeowners keep up with their mortgage payments. This has also given financially distressed owners a chance to sell their properties on their own, rather than face foreclosure.

But overall, because the property market here is tightly regulated and generally resilient (plus the consistent demand for housing and relatively low unemployment rates), very few owners end up in situations where their properties get repossessed.

- Possible discounts

The main appeal of buying a foreclosed property is the possibility of securing it below market value. Since banks are focused on recovering the outstanding loan rather than making a profit, they often set a bidding price that's lower than typical resale listings.

- Straightforward and quick

When you buy from an individual owner, negotiations can be long. Sellers might hold out for a higher price, change their minds halfway, or drag timelines while waiting for a better offer.

With foreclosure, it's different. It's more structured. The bank has no other intention than to recover the outstanding loan. There is also a strict timeline to follow, so there would be no back-and-forth haggling between the buyer and the bank. That means the process is more straightforward and faster.

In fact, after winning a property at auction, you (the buyer) must immediately provide identification and pay the deposit by cheque. The sale then moves straight to the Conditions of Sale. The balance is usually due within 8-12 weeks, during which lawyers handle the paperwork. Once completed, the property is yours.

- Rare Properties

Another interesting aspect of foreclosures is that you sometimes see properties you'd rarely find in the open market. Think prime district condos where owners usually hold long-term, freehold units passed down through generations, or even landed homes that seldom change hands. Because financial distress can strike any segment, the foreclosure pool occasionally includes these "hard-to-get" units.

- Sold as is

Foreclosed properties are sold in their current state. The bank will not spruce them up, repaint walls, or fix broken fittings. If you're lucky, you may bid on a well-maintained home. But there are cases where the property is in poor condition. From leaky pipes to peeling paint, all this becomes your responsibility (and expense!) once you take over.

That's why you shouldn't rely solely on what the auctioneer says. Remember, their job is to close the sale, not to protect your interests. So, you need to look up reviews and photos online, even visit the property yourself. Most of the time, buyers are allowed a viewing slot about one to two weeks before the auction. Bring your property agent with you while you're at it. They are legally obliged to look after your interest, and they can help spot issues that you might overlook.

- Little time, big decision

We usually take our time to really consider big purchases like properties. But unfortunately, you don't get the luxury of time when it comes to foreclosed homes. Listings are usually released shortly before the auction date.

This means you only have a short window to get everything done. From doing market research and viewing the unit to seeking legal advice and secure financing. Things that typically take months now have to be done within a short timeframe (typically two weeks). There's barely any room to breathe and consider your options.

- Discounts are NOT guaranteed

While opening bids may seem attractive, competitive bidding can quickly push prices up. As a matter of fact, auction properties usually close near valuation, and sometimes even higher if bidding is competitive (this is especially true for rarer units). So you have to be careful not to get swept up in the heat of the auction, or you might end up paying more than the property is actually worth.

In any case, if the reserve price is unusually low, it could be a red flag that the property isn't worth much to begin with. In some cases, the house could be in such poor condition that the cost of restoring it might end up exceeding its actual value.

- Check your eligibility

For Singapore citizens, buying a private residential property usually comes with no major eligibility hurdles. But for foreigners and Singapore Permanent Residents (PRs), the rules are stricter. Under the Residential Property Act, you'll need prior approval from Singapore Land Authority's Land Dealings (Approval) Unit before you can purchase restricted residential properties. These include landed homes such as detached, semi-detached, terrace houses, as well as cluster housing. You can read more about buying a property in Singapore as a foreigner here.

- Secure your funds early

Winning a property at auction isn't like buying in the open market where you have time to sort out financing after negotiations. If your bid is successful, you'll need to put down a deposit of around 5-10% of the purchase price on the spot, usually by cheque. This means your finances must already be in order before you even step into the auction hall.

One way to prepare is to apply for an In-Principle Approval (IPA) on your home loan beforehand, so you know how much you can borrow and avoid overcommitting during the heat of bidding.

- Don't forget stamp duties

Don't forget that you still have to pay stamp duties! If you already own a property, or if you're a foreign buyer, the Additional Buyer's Stamp Duty (ABSD) can be quite hefty. So, do consider this beforehand.

- Get professional advice

Unlike a standard transaction, auction documents may contain special conditions of sale. So it's much better to consult a professional, like a property agent or conveyancing lawyer, in advance, so they can review the fine print and highlight any red flags. Having them on your side means you won't miss crucial details that could cost you later.

- Register as a bidder

Property auctions are typically held every month by estate agencies such as JLL. While anyone can attend, only registered participants are allowed to place bids. So you need to register with the estate agency conducting the auction.

It doesn't hurt to attend an auction or two just to see how it works, but don't expect to find amazing deals. Best case scenario, your winning bid is slightly below market value. But once you factor in renovation costs, taxes, and fees, the savings may not be as big as you imagined. Still, if you've done your research, set a firm budget, and consulted with the right pros, you might get exactly what you're looking for.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.